“It’s a recession when your neighbor loses his job; it’s a depression when you lose yours.”

-Harry Truman (US President 1945-1953)

You know the current market scenario and the situation of jobs. With coronavirus pandemic that shot as a threat to public health; the outbreak has put forward troublesome economic questions. One of the most prominent questions is – “Is this scenario prelude to the world economic recession?” An economic slowdown or a potential recession is not difficult to be foreseen in this situation and that is what keeping you worried. As it might hit your finances hard, worrying over it is natural and obvious. But every cloud has a silver lining; so does this situation. Economy drops and unemployment rises but the economy recovers soon. It is just another difficult phase that won’t last forever. You can be prepared to face and come out victoriously with some daily habits and new ways; thereby safeguard yourself from the recession sting and its aftermaths.

How to be Financially Stable during a Recession

1. Clear Your Debts

Your debts will remain the same during recession and your debt collectors don’t care how you are going to pay them. All they need is the amount with interest on time. To keep you in a better position for an upcoming recession, try to clear your debts or at least pay a huge chunk at the earliest. Evaluate the amount you can pay for debts every month and get them off or make them light from your budget and bank balance.

2. Get Emergency Funds Ready

An old adage goes that hope for the best and be prepared for the worst. So while hoping that the best will come, prepare yourself for the worst. Get your emergency fund ready and safeguard your finances so that you are prepared during recession with stable financial backing. It will help you during the unfortunate event of job loss, car repair, or home repair/renovation. Open a new savings account that fetches you a good rate of interest, without restrictions or penalties on withdrawal. Keep fueling this bank account with some amount on monthly basis. Most especially, deposit the amount into it whenever you bet some extra money. This will keep your additional money safe and make you strong in times of financial crisis.

3. Budget and Save

Ensure that you spend wisely and save more than you spend. By doing so, you can go for investments, build assets and emergency funds, and thus get ready in advance for any unexpected situations. If a recession is speculated to be round the corner, you have all the more reasons to calculate your cost of living. Evaluate your spending patterns and make budget where you can estimate savings. This will help you keep a track of your expenses and savings as well as maintain a good bank balance.

4. Assess Your Professional Situation

During recession, jobs turn unsustainable, almost in all the industries. Organizations are left with no other choice than to cut the costs. No wonder many costs are hacked-off, whether in the name of staff attrition or non-essentials. Ponder if your organization considers your skills essential. If your answer is not in your favor, start expanding your skills, grow your network, and make efforts to grab new job as soon as possible. There are many online academies that offer free courses or paid courses at highly discounted price.

5. Earn through an Additional Source

Plan to have an extra source of income, depending on your talent and skills. As a huge question mark arises on job security during recession, it is wise to start early with some other earning that would support you if unfortunately you come into the staff attrition bracket. If the direct source of income is lost, you will at least have another one to sustain yourself. Even though, you might not earn as great as full-time job but you won’t be left helpless. In such difficult situations, every bit counts. As you diversify your ways of earning, your investments diversify that will support you in situation of financial crunch. As the economy recovers, you might find yourself in a better financial position.

6. Maintain Your Credit Score

Image Source

Maintaining a good credit score is healthy for your financial status. It keeps all the doors open for lucrative opportunities, be it borrowing money at low interest rates. One of the wise approaches to build a good credit score is to keep the balance low, while having a credit card. Also, pay bills and installments regularly for your credit card or any loan.

7. Go for Long-Term Investments

If you have already invested your money somewhere but a good percentage like 15% descends with the drop in market. What will you do? First of all, don’t lose heart. Once the market recovers, you will have a plethora of opportunities to make it big. As a matter of fact, you might end up flooded by profits if you but when the market if down. Ensure to have enough money and low-risk investments. Allow the stock portion of your portfolio some time to recover.

8. Diversify Your Portfolio

Image Source

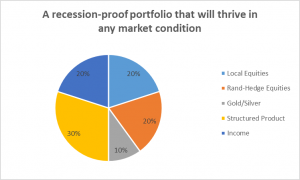

Make your portfolio recession proof because such a portfolio plays an instrumental role in being ready for recession and make ROIs smooth. Spread your money across various assets. By doing so, you restrict any negative exposure on your plan. Choose to go with possible recession proof assets such as government bonds and gold. Additionally, consumer staples and utilizes are also said to survive a dwindling economy.

Bonus: Tips from the Great Depression

Recession reminds us of the greatest dip in the world economy in 1930 – The Great Depression. Hopefully and even calculations support that no market crash will be as dire as that depression. But we have to be ready at all times with some smart tips to save money.

In addition to the above mentioned tips to clear debts and save more, here are a few more hacks for you:

- Remember the three “Rs” – Reuse, Reduce, and Recycle.

- Grow your own food – Use your backyard or lawn as your kitchen garden. Plant fruits and veggies that you can grow on your own along with seasonal herbs. This will help you feed healthy and cut the costs on grocery.

- Don’t waste food – Respect your food and preserve surplus quantity if you have. Preserve it in cans or jars and use when needed the most.

Thus, put your fears to rest. If the recession hits, you will be ready with the above ideas to get through with some financial backup. Recessions are inevitable but they aren’t predictable even. The shrinking economy is visible. Such economic situations cause havoc on people’s financial lives worldwide even before economic growth resumes. But some recessions are mild too. However, it can’t be estimated exactly when they will hit or how bad they will be. At the same time, you can survive a recession with the tips above. Being prepared financially for an economic dip, you will be in a strong position to face the tough times ahead.